It’s hard to scroll through your news feed lately without seeing a headline claiming that big institutional investors are “buying up all the homes.” If you’re a local homebuyer who has faced a multi-offer situation in San Pedro or watched a fixer-upper in Rancho Palos Verdes get snatched up in days, those scenarios can feel very real. When inventory is tight and prices remain resilient, it’s easy to assume giant Wall Street investment firms are behind the scenes scooping up every available property.

However, as we often discuss in our market reviews, there is a big difference between “headline noise” and what the actual data tells us. Today, we want to share the reality of institutional investor activity to see how much of a footprint they truly have in the housing market.

The Numbers vs. The Narrative

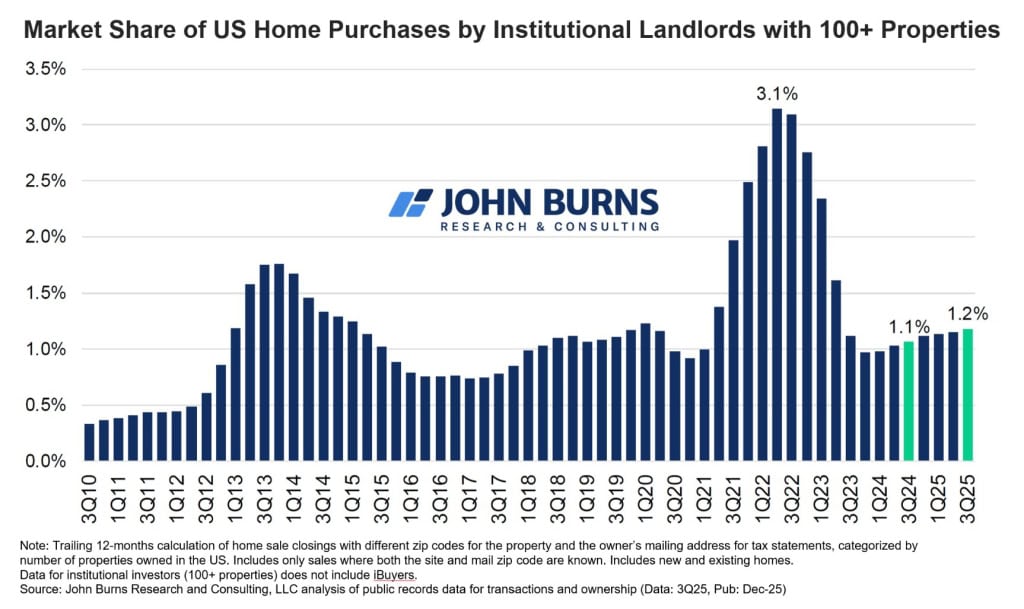

While the internet might make it seem like every other home is being bought by a massive corporation, the national data tells a much quieter story. According to the latest data from John Burns Research & Consulting (JBREC), large institutional investors—defined as those owning 100 or more properties—accounted for just 1.2% of all home purchases in Q3 of 2025.

John Burns Research & Consulting

To put that into perspective, for every 100 homes sold, only about one was purchased by a large institution. As you can see from the chart, this is a significant drop from the peak of 3.1% we saw in 2022. In fact, current activity has returned to the historical norms we saw back in 2018 and 2019—the last “normal” years before the pandemic frenzy.

Why the Confusion?

If the percentage is so low, why does it feel like investors are everywhere? There are two main reasons for this perception:

-

Regional Concentration: Investor activity isn’t spread evenly across the map. While the national average is 1.2%, some regions (particularly in the Sunbelt) see much higher concentrations. Here in our coastal pocket of the South Bay, our high median home prices—ranging from $1.05M in San Pedro to over $1.85M in RPV—actually act as a natural barrier to many of these large-scale “bulk” buyers who typically look for lower entry points to maximize their rental yields.

-

The “Investor” Label is Broad: Headlines often lump massive Wall Street firms together with small, local “mom and pop” investors. There is a huge difference between a billion-dollar hedge fund and a local San Pedro family buying a second property to rent out for retirement income. Most “investors” in our community are actually your neighbors, not corporate boardrooms.

What Truly Drives Our Local Market

In our experience serving the San Pedro and Peninsula communities, the challenges we face with affordability and competition aren’t being driven by Wall Street. Instead, they are the result of three main factors we track closely:

-

Persistently Low Inventory: We continue to see a “lock-in” effect where homeowners with historically low mortgage rates are hesitant to sell.

-

The Lifestyle Draw: Whether it’s the walkable coastline of San Pedro or the panoramic ocean views of RPV, the South Bay remains a “destination” market where demand consistently outpaces supply.

-

A Stable Job Market: A strong local economy keeps serious buyers active, even when interest rates hover in the 6% to 7% range.

The Bottom Line

While big investors do exist, they are responsible for a very small slice of the overall market. The bigger story continues to be the balance between local supply and demand. If you’ve been sitting on the sidelines because you’re worried about competing with “Big Capital,” it might be time to take another look at the data.

Success in this market requires a strategy—whether that means pricing your home correctly from day one to generate urgency or being proactive with your financing as a buyer. As local independent brokers, we take pride in helping our clients separate fact from fiction so they can make the best decisions for their families.